Turkey enjoying decade-long economic boom

By The Economist

But ominous signs of a crash prevail

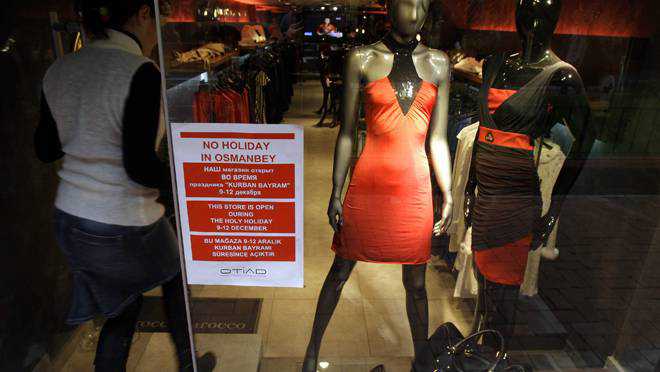

A shopper enters a store in Istanbul. Cheap money in the rich world has allowed Turkey to dodge an immediate crisis. And if liquidity remains plentiful, the country may continue to skirt trouble for some time. (CP)

Compared with the mess that many rich countries are in, most emerging economies seem in pretty good shape.

To be sure, plenty saw their growth rates slow sharply last year. And as fears over the euro’s future escalated, some currencies and stock markets slumped.

But apart from the poorest places that habitually rely on the International Monetary Fund’s subsidized help, only a handful of emerging economies, mainly in Eastern Europe, have had to turn to it for funds.

This resilience is impressive. But it would be a mistake to assume it will last for ever.

For even as rich-world investors pile back into emerging market funds, a quick glance at these countries’ vital statistics suggests that plenty of places have a problem or two. India has a big budget deficit. Several countries, from Venezuela to Vietnam, have double-digit inflation. South Africa has a sizeable current-account deficit.

But based on the standard warning signs of trouble — from rapid credit growth and high inflation to a big external deficit — one country stands out.

It is Turkey.

For the past decade, Turkey has enjoyed a spectacular boom, fuelled by equally spectacular foreign borrowing. The economy grew by 8.5 per cent last year, driven by credit that at one point was surging at an annual pace of more than 40 per cent. Foreigners lent much of the cash.

Turkey’s current-account deficit exceeded 10 per cent of gross domestic product, more than twice as much as any of the emerging markets regularly tracked by The Economist.

This turbocharged growth slowed sharply at the end of last year, as investors’ jitters and a sharp fall in the Turkish lira forced the central bank to tighten monetary policy. Figures released on April 2 showed that annual GDP growth slowed to 5.2 per cent in the fourth quarter of 2011, and initial evidence suggests a further deceleration this year.

Unfortunately, the imbalances remain. Even with much slower growth, inflation is above 10 per cent and the current-account deficit is likely to stay around eight per cent of GDP.

With little foreign direct investment, most of that deficit will need to be funded by flighty bond and bank finance. Turkey, in short, has not just overheated. It has a growing competitiveness problem and a dangerous addiction to the riskiest types of foreign capital.

For now, foreigners seem unworried. The lira has strengthened, and the Istanbul stock market is up by 20 per cent since the start of the year.

But the apparent revival of capital inflows probably has less to do with confidence in Turkey’s economy than the largesse of rich-world central banks, particularly the European Central Bank’s massive provision of liquidity.

Cheap money in the rich world has allowed Turkey to dodge an immediate crisis. And if liquidity remains plentiful, the country may continue to skirt trouble for some time.

But eventually, on today’s course, the danger of some kind of crash is worryingly large.

To lessen that danger, Turkey needs to boost its savings and improve its competitiveness. With its private sector addicted to spending on foreigners’ dimes, Turkey’s government needs to compensate by saving more.

In fact, the opposite has been happening. Although Turkey’s fiscal position is healthy compared with those of other emerging economies, the tax take has been flattered by the unsustainable import boom. Adjust for these transient revenues and the IMF calculates that Turkey’s underlying budget balance, before interest payments, has shifted from a surplus of around five per cent of GDP between 2003 and 2006 to a deficit now.

Tighter fiscal policy would help reduce the current-account deficit. But it will not be enough. A lasting improvement in Turkey’s external accounts demands structural reforms to boost competitiveness and improve the flexibility of its workers. It is a puzzle that, for all its booming growth, Turkey does not attract more foreign direct investment.

One reason may be its labour laws, which in many ways look like those of a rigid southern European economy. Another obstacle to investment is a thicket of regulations. Turkey ranks 71st in the World Bank’s Doing Business league tables, better than Greece but worse than Kazakhstan.

These kinds of reforms will take time, so it is essential that Turkey’s leaders start now, even if low interest rates in the rich world keep the foreign money flooding in. The trouble is that most of those leaders do not recognize the urgency.

via Turkey enjoying decade-long economic boom | The Chronicle Herald.

Leave a Reply