-

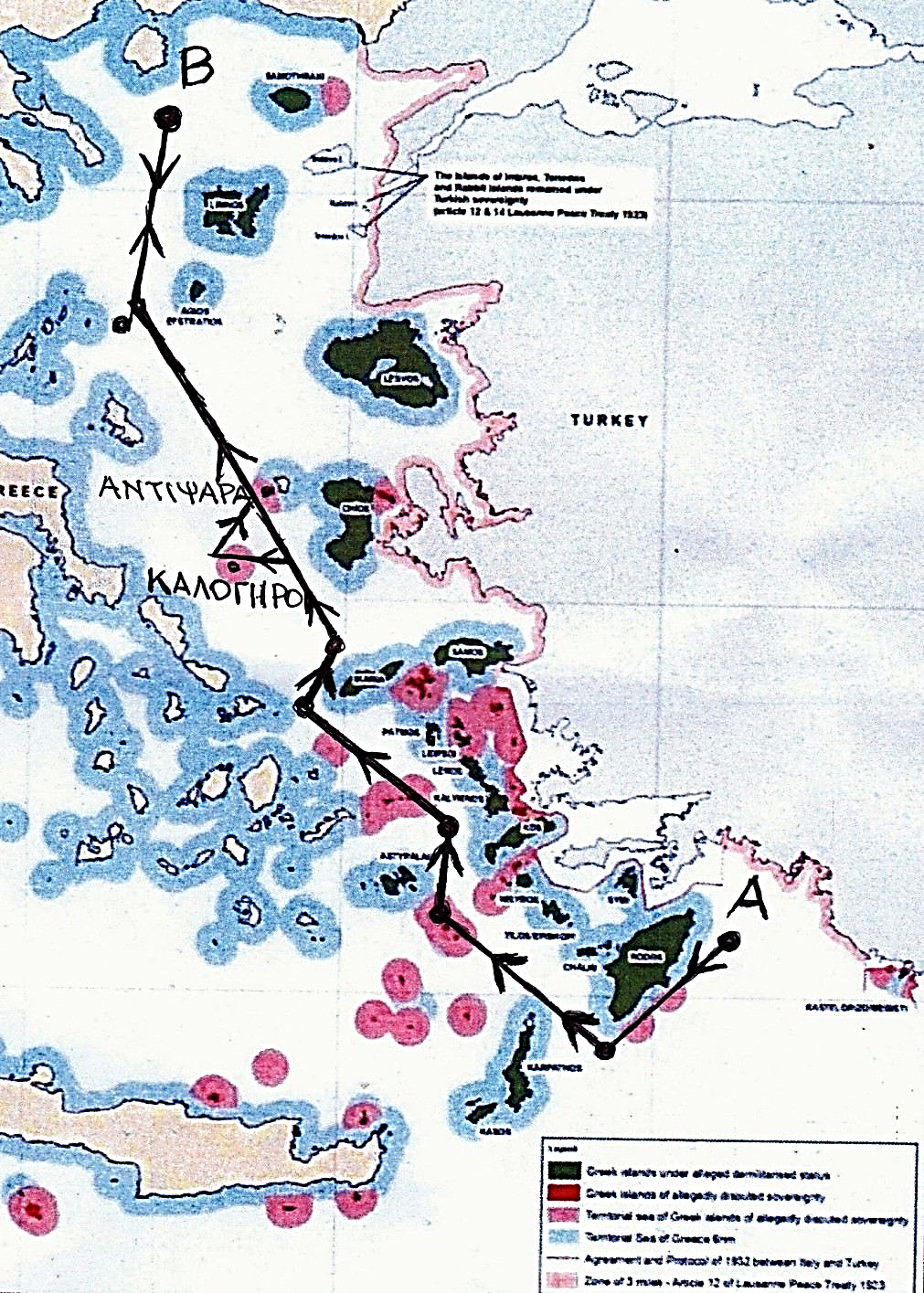

Backdoor of the United States for the Aegean!

Blinken’s second letter to Congress facilitates and serves Turkey to permanently challenge Greek sovereignty over islands and islets 25.02.2024 • 22:03 The Biden administration with […]

-

Turkey Bans Entry of Foreigners Who Criticize President Erdogan

The Turkish government, led by the autocratic leader Recep Tayyip Erdogan, has banned the entry of over 100,000 foreigners from 150 countries, including journalists and […]

-

Pashinyan is a Greater Threat to Armenia’s Security, Than Artsakh’s Government-in-Exile

We all know the disasters that Prime Minister Nikol Pashinyan brought upon Armenia in addition to losing Artsakh due to his incompetence. We can cite […]

-

Turkey’s 5th Generation Fighter: KAAN

Turkey’s TF Kaan 5th Generation Fighter On the 21st of February 2024, a new 5th-gen fighter took to the skies. The Turkish Aerospace Industries TF […]

-

Putin’s Friend, Wanted by Ukraine, Perpetrator of Crimes in Karabakh

By Azer HASRET I believe that this information will be of interest to our esteemed readers. That’s why I’m reprinting it. The information below is […]

-

German Television Exposes Azerbaijan’s Massive Bribery of European Officials

This is not the first time that autocratic Azerbaijan has come under scrutiny for handing out billions of dollars in bribes to Western officials to […]

-

The World War II: rethink but not falsify

Amidst the global turbulence and the era of information there is a high risk to lose the historical heritage both material and the one that’s […]

-

Why No Turkish

The European Union’s pressure on the Greek Cypriot Administration on the issue of golden passports has started to yield results. The Greek Cypriot Administration will […]

-

ARMENIAN DEPORTATION IS NOT A GENOCIDE….!

“The fact that there had ben massacres ( of Armenians) is obvious and clear. Everyone agrees on this. Essentially, nobody denies this fact. The important […]

-

Americans Sailing to a Muslim Country

It has been said that cruising is the art of doing boat work in exotic locals and honestly that’s not far from the truth. Atticus […]

Join 900+ subscribers

Stay in the loop with everything you need to know.